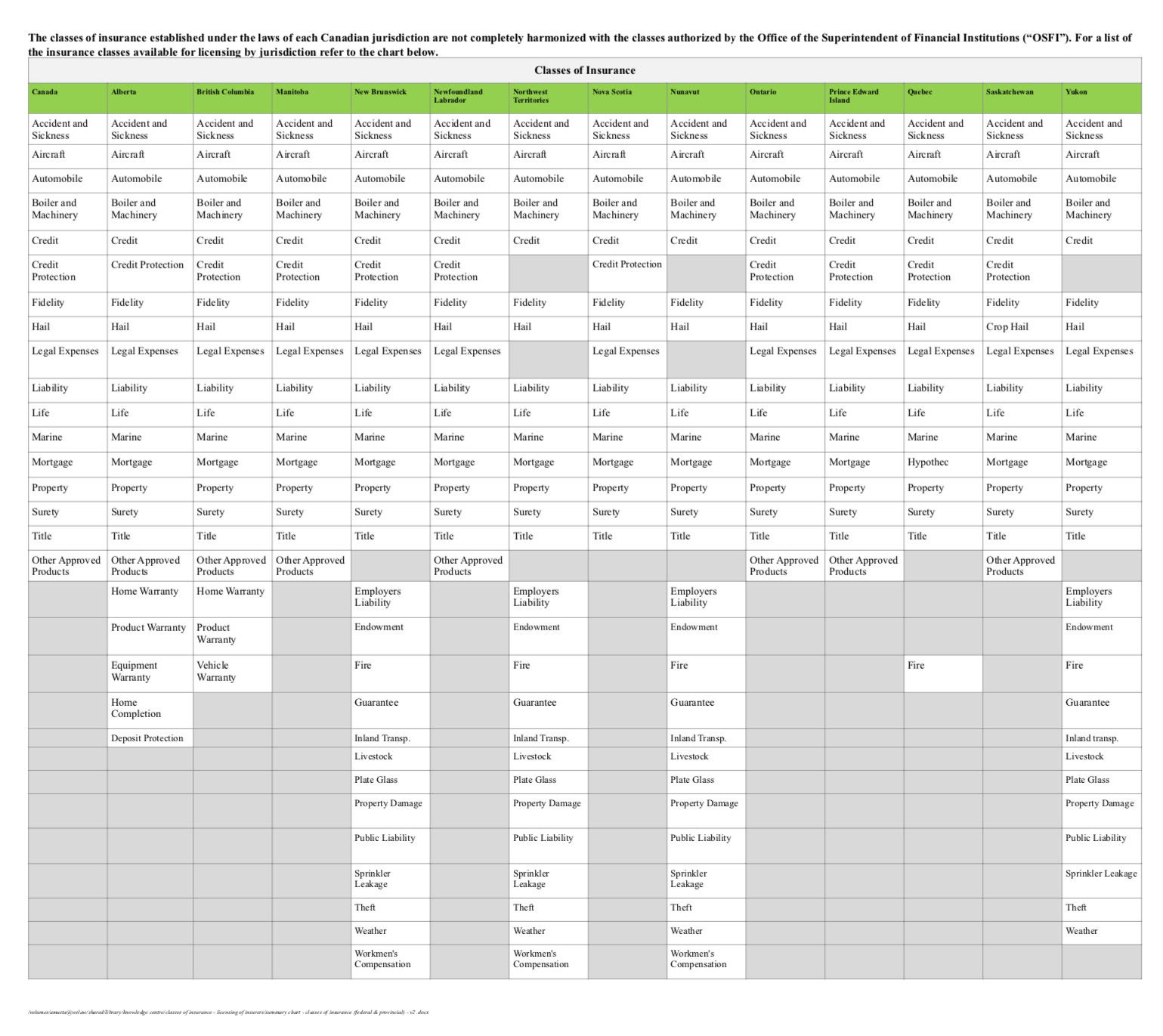

Our Classes of Insurance Module provides information with respect to the different classes of insurance across Canada. For a summary of the insurance classes available for licensing by jurisdiction refer to the chart below.

Accident and Sickness Insurance

means insurance

- against loss resulting from bodily injury to, or the death of, a person caused by an accident,

- under which an insurer undertakes to pay a certain sum or sums of insurance money in the event of bodily injury to, or the death of, a person caused by an accident,

- against loss resulting from the sickness or disability of a person, excluding loss resulting from an accident or death,

- under which an insurer undertakes to pay a certain sum or sums of insurance money in the event of the sickness or disability of a person not caused by an accident, or

- under which an insurer undertakes to pay insurance money in respect of the health care, including dental care and preventative care, of a person;

Aircraft Insurance

means insurance against

- liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, in each case caused by an aircraft or the use of an aircraft; or

- the loss of, the loss of use of, or damage to, an aircraft.

Automobile Insurance

means insurance

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, in each case caused by an automobile or the use or operation of an automobile,

- against the loss of, the loss of use of or damage to an automobile, or

- that falls within paragraph (a) or (b) of the class of accident and sickness insurance, if the accident is caused by an automobile or the use or operation of an automobile, whether or not liability exists in respect of the accident, and the policy includes insurance against liability arising out of bodily injury to, or the death of, a person caused by an automobile or the use or operation of an automobile.

Boiler and Machinery Insurance

means insurance

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, or against the loss of, or damage to, property, in each case caused by the explosion or rupture of, or accident to, pressure vessels of any kind or pipes, engines and machinery connected to or operated by those pressure vessels; or

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, or against the loss of, or damage to, property, in each case caused by a breakdown of machinery.

Credit Insurance

means insurance against loss to a person who has granted credit if the loss is the result of the insolvency or default of the person to whom the credit was given.

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual’s income or ability to earn an income;

Fidelity Insurance

means insurance

- insurance against loss caused by the theft, the abuse of trust or the unfaithful performance of duties, by a person in a position of trust; and

- insurance under which an insurer undertakes to guarantee the proper fulfilment of the duties of an office.

Hail Insurance

means insurance against the loss of, or damage to, crops in the field caused by hail.

Legal Expenses Insurance

means insurance against the costs incurred by a person or persons for legal services specified in the policy, including any retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services.

Liability Insurance

means insurance, other than insurance that falls within another class of insurance,

- against liability arising out of bodily injury to or the disability or death of a person, including an employee,

- against liability arising out of the loss of or damage to property, or

- if the policy includes the insurance described in subclause (i), against expenses arising out of bodily injury to a person other than the insured or a member of the insured’s family, whether or not liability exists;

Life Insurance

- means any insurance that is payable

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

- without restricting the generality of paragraph (a), includes insurance under which an insurer

- undertakes to pay an additional sum of money in the event of the death by accident of the person whose life is insured,

- undertakes to pay an additional sum of money in the event of the death by accident of the person whose life is insured,

Marine Insurance

means insurance against

- liability arising out of,

- bodily injury to or the death of a person, or

- the loss of or damage to property, or

- the loss of or damage to property,

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on, or other security interest in, real property.

Other Approved Products Insurance

means insurance against risks that do not fall within another class of insurance.

Property Insurance

means insurance against the loss of, or damage to, property and includes insurance against loss caused by forgery.

Surety Insurance

means insurance under which an insurer undertakes to guarantee the due performance of a contract or undertaking or the payment of a penalty or indemnity for any default.

Title Insurance

means insurance against loss or damage caused by

- a defect in any document that evidences the creation of any restriction referred to in paragraph (a) or (b);,

- a defect in the title to property, or

- any other matter affecting the title to property or affecting the right to the use and enjoyment of property;

Accident and Sickness Insurance

means insurance

- against loss resulting from bodily injury to, or the death of, a person caused by an accident,

- under which an insurer undertakes to pay a certain sum or sums of insurance money in the event of bodily injury to, or the death of, a person caused by an accident,

- against loss resulting from the sickness or disability of a person, excluding loss resulting from an accident or death,

- under which an insurer undertakes to pay a certain sum or sums of insurance money in the event of the sickness or disability of a person not caused by an accident, or

- under which an insurer undertakes to pay insurance money in respect of the health care, including dental care and preventative care, of a person;

Aircraft Insurance

means insurance

- liability arising out of bodily injury to or the death of a person or the loss of or damage to property, in each case caused by an aircraft or the use of an aircraft, or

- the loss of, the loss of use of or damage to an aircraft;

Automobile Insurance

means insurance

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, in each case caused by an automobile or the use or operation of an automobile,

- against the loss of, the loss of use of or damage to an automobile, or

- that falls within clause (a)(i) or (ii) of the definition of accident and sickness insurance, if the accident is caused by an automobile or the use or operation of an automobile, whether or not liability exists in respect of the accident, and the policy includes insurance against liability arising out of bodily injury to or the death of a person caused by an automobile or the use or operation of an automobile;

Boiler and Machinery Insurance

means insurance

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, or against the loss of or damage to property, in each case caused by the explosion or rupture of or accident to pressure vessels of any kind or pipes, engines and machinery connected to or operated by those pressure vessels, or

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, or against the loss of or damage to property, in each case caused by a breakdown of machinery;

Credit Insurance

means insurance against loss to a person who has granted credit if the loss is the result of the insolvency or default of the person to whom the credit was given;

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual’s income or ability to earn an income;

Deposit Protection Insurance

means insurance against the loss of a deposit paid to a residential builder or developer for the construction or reconstruction of a new home or for the purchase of land;

Equipment Warranty Insurance

means the subclass of boiler and machinery insurance that comprises insurance against loss of or damage to a motor vehicle or to equipment arising from its mechanical failure, but does not include automobile insurance or insurance incidental to automobile insurance;

Fidelity Insurance

means insurance

- against loss caused by the theft, the abuse of trust or the unfaithful performance of duties by a person in a position of trust, or

- under which an insurer undertakes to guarantee the proper fulfilment of the duties of an office;

Hail Insurance

means insurance against the loss of or damage to crops in the field caused by hail;

Home Completion Insurance

means insurance against the default of a residential builder to complete the construction or reconstruction of a new home;

Home Warranty Insurance

means insurance against defects in the construction of a new home and consequential losses or costs incurred by the owner;

Legal Expenses Insurance

means insurance against the costs incurred by a person or persons for legal services specified in the policy, including any retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services;

Liability Insurance

means insurance, other than insurance that falls within another class of insurance,

- against liability arising out of bodily injury to or the disability or death of a person, including an employee,

- against liability arising out of the loss of or damage to property, or

- if the policy includes the insurance described in subclause (i), against expenses arising out of bodily injury to a person other than the insured or a member of the insured’s family, whether or not liability exists;

Life Insurance

- means any insurance that is payable

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

- without restricting the generality of subclause (i), includes

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay an additional sum of insurance money in the event of the death by accident of the person whose life is insured,

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

Marine Insurance

means insurance against

- liability arising out of,

- bodily injury to or the death of a person, or

- the loss of or damage to property, or

- the loss of or damage to property,

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on or other security interest in real property.n.

Other Approved Products Insurance

means insurance against risks that do not fall within another class of insurance.

Product Warranty Insurance

means insurance not incidental to any other class of insurance against loss of or damage to personal property other than a motor vehicle under which an insurer undertakes to pay the costs of repairing or replacing the personal property.

Property Insurance

means insurance against the loss of or damage to property and includes insurance against loss caused by forgery.

Surety Insurance

means insurance under which an insurer undertakes to guarantee the due performance of a contract or undertaking or the payment of a penalty or indemnity for any default.

Title Insurance

means insurance against loss or damage caused by

- a defect in any document that evidences the creation of any restriction referred to in subclause (i) or (ii),

- a defect in the title to property, or

- any other matter affecting the title to property or affecting the right to the use and enjoyment of property;

Accident and Sickness Insurance

means insurance

- against loss resulting from bodily injury to, or the death of, a person caused by an accident,

- under which an insurer undertakes to pay a sum or sums of insurance money in the event of bodily injury to, or the death of, a person caused by an accident,

- against loss resulting from the sickness or disability of a person not caused by an accident, but does not include insurance for losses resulting from the death of a person caused by sickness,

- under which an insurer undertakes to pay a sum or sums of insurance money in the event of the sickness or disability of a person not caused by an accident, or

- under which an insurer undertakes to pay a sum of insurance money in respect of the health care, including dental care and preventative care, of a person.

Aircraft Insurance

means insurance

- liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, caused by an aircraft or the use of an aircraft, or

- the loss of, the loss of use of, or damage to, an aircraft.

Automobile Insurance

means insurance

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, caused by an automobile or the use or operation of an automobile,

- against the loss of, the loss of use of, or damage to, an automobile, or

- that falls within paragraph (a) or (b) of the definition of "accident and sickness insurance", if

- the accident is caused by an automobile or the use or operation of an automobile, whether or not liability exists in respect of the accident, and

- the policy includes insurance against liability arising out of bodily injury to, or the death of, a person caused by an automobile or the use or operation of an automobile.

Boiler and Machinery

means insurance against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, or against the loss of, or damage to, property, caused by

- the explosion or rupture of, or accident to, pressure vessels of any kind or pipes, engines and machinery connected to or operated by those pressure vessels, or

- a breakdown of machinery.

Credit Insurance

means insurance against loss to a creditor if the loss is the result of the insolvency or default of the creditor's debtor.

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual's income or ability to earn an income.

Fidelity Insurance

means insurance

- against loss caused by theft, the abuse of trust or the unfaithful performance of duties, by a person in a position of trust, and

- under which an insurer undertakes to guarantee the proper fulfillment of the duties of an office.

Hail Insurance

means insurance covering defects in the construction of a new home or renovation, and consequential losses or costs incurred by the owner.

Home Warranty Insurance

means insurance covering defects in the construction of a new home or renovation, and consequential losses or costs incurred by the owner.

Legal Expenses Insurance

means insurance against costs incurred for legal services specified in the policy, including any retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services.

Liability Insurance

means insurance, other than insurance that falls within another class of insurance,

- against liability arising out of bodily injury to, or the disability or death of, a person, including an employee,

- against liability arising out of the loss of, or damage to, property, or

- if the policy includes the insurance described in paragraph (a), against expenses arising out of bodily injury to a person other than the insured or a member of the insured's family, whether or not liability exists.

Life Insurance

means insurance that is payable

- on the death of the person whose life is insured,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

- including, without limiting paragraphs (a) to (d), insurance under which the insurer

- undertakes to pay an additional sum of insurance money in the event of the death by accident of the person whose life is insured,

- undertakes to pay a sum of insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, or

- undertakes to provide an annuity, or what would be an annuity except that the periodic payments may be unequal in amount, for a term dependent solely or partly on a human life.

Marine Insurance

means insurance against

- liability arising out of

- bodily injury to, or the death of, a person, or

- the loss of, or damage to, property, or

- the loss of, or damage, to property,

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on, or other security interest in, real property.

Other Approved Products Insurance

means all types of insurance not otherwise included in another class of insurance.

For the purposes of this class of insurance, the commission may specify in the business authorization of a particular insurer the types of insurance business the insurer may carry on within that class.

Product Warranty Insurance

means insurance, not being insurance included in or incidental to any other class of insurance, under which the insurer undertakes, in the event of loss of, or damage to, personal property, other than a motor vehicle, to pay, for a specified period after it is purchased, the cost of repairing or replacing the personal property.

Property Insurance

means insurance against the loss of, or damage to, property, and includes insurance against loss caused by forgery.

Surety Insurance

means insurance under which an insurer undertakes

- to guarantee the due performance of a contract or undertaking, or

- to pay a penalty or indemnity for any default in the performance of a contract or undertaking.

Title Insurance

means insurance against loss or damage caused by

- the existence of a mortgage, charge, lien, encumbrance, servitude or any other restriction on real property,

- the existence of a mortgage, charge, lien, pledge, encumbrance or any other restriction on personal property,

- a defect in any document that evidences the creation of any restriction referred to in paragraph (a) or (b),

- a defect in the title to real or personal property, or

- any other matter affecting the title to real or personal property or affecting the right to the use and enjoyment of real or personal property.

Vehicle Warranty Insurance

means insurance, not being insurance included in or incidental to automobile insurance, under which the insurer undertakes, in the event of loss of, or damage to, a motor vehicle arising from mechanical failure, to pay, for a specified period after the motor vehicle is purchased,

- the cost of repairing or replacing the motor vehicle,

- towing fees,

- the cost of renting a substitute motor vehicle, or

- the cost of accommodation required because of the mechanical failure.

Accident and Sickness Insurance

- The class of accident and sickness insurance is insurance under which the insurer undertakes

- to indemnify a person against loss, or to pay insurance money or another thing of value in respect of loss, resulting from the sickness or disability of a person not caused by an accident, other than loss resulting from the death of the person as a consequence of sickness;

- to pay a specified amount of insurance money in the event of the sickness or disability of a person not caused by an accident; or

- to pay insurance money in respect of the health care — including dental care and preventative care — of a person.

Aircraft Insurance

The class of aircraft insurance is insurance under which insurer undertakes

- to indemnify a person against liability arising out of

- bodily injury to or the death of another person, or

- the loss of or damage to property, caused by an aircraft or resulting from the use of an aircraft; or

- to indemnify a person against, or to pay insurance money or another thing of value in respect of, the loss of or damage to, or the loss of use of, an aircraft

Automobile Insurance

The class of automobile insurance is insurance under which insurer

- undertakes to indemnify a person against liability arising out of

- bodily injury to or the death of another person, or

- the loss of or damage to property, caused by an automobile or the use or operation of an automobile;

- undertakes indemnify a person against, or to pay insurance money or another thing of value in respect of, the loss or loss of use of, or damage to, an automobile; or

- as part of a contract of automobile insurance that provides the insurance described in subclause (a)(i), undertakes

- to indemnify a person against loss, or to pay insurance money or another thing of value in respect of loss, resulting from bodily injury to, or the death of, a person caused by an accident, or

- to pay a specified amount of insurance money in the event of bodily injury to, or the death of, a person caused by an accident, when the accident is caused by an automobile or the use or operation of one, whether or not liability exists in respect of the accident.

Boiler and Machinery Insurance

The class of boiler and machinery insurance is insurance under which insurer undertakes

- to indemnify a person against liability arising out of

- bodily injury to or the death of another person, or

- the loss of or damage to property,

- to indemnify a person against, or to pay insurance money or another thing of value in respect of, loss of or damage to property caused by the explosion or rupture of, or accident to, a pressure vessel of any kind or pipes and machinery connected to or operated by the pressure vessel or by a breakdown of machinery.

Credit Insurance

The class of credit insurance is insurance under which the insurer undertakes to indemnify a person against loss, or to pay insurance money or another thing of value in respect of a person's loss, resulting from the insolvency or default of a person to whom the credit was given.

Credit Protection Insurance

The class of credit protection insurance is insurance under which the insurer undertakes to pay insurance money to pay off, in whole or in part, credit balances or debts of an individual in the event of the impairment or potential impairment in the individual’s income or ability to earn an income.

Deposit Protection Insurance

The class of fidelity insurance is insurance under which the insurer undertakes

- to indemnify a person against loss, or to pay insurance money or another thing of value in respect of loss, caused

- by theft,

- by the abuse of trust, or

- by the unfaithful performance of duties,

- to pay insurance money or another thing of value to guarantee the proper fulfilment of the duties of an office.

Hail Insurance

The class of hail insurance is insurance under which the insurer undertakes to indemnify a person against, or to pay insurance money in respect of, the loss of or damage to crops in the field caused by hail.

- the retainer, if any, and fees incurred for the services, and

- other costs incurred in respect of the provision of the services.

Legal Expenses Insurance

The class of legal expenses insurance is insurance under which insurer undertakes to indemnify a person against, to pay insurance money or another thing of value in respect of, costs incurred by the person for legal services specified in the legal expenses insurance policy, including

Liability Insurance

The class of liability insurance is insurance under which the insurer, otherwise than incidentally to another class of insurance,

- undertakes to indemnify a person against liability arising out of bodily injury to or the disability or death of a person, including an employee;

- undertakes to indemnify a person against liability arising out of the loss of or damage to property; or

- undertakes, as part of a contract of liability insurance that provides the insurance described in clause (a), to indemnify a person against, or to pay insurance money or another thing of value in respect of, expenses arising out of bodily injury to a person other than the insured or a member of the insured’s family, whether or not liability exists.

Life Insurance

- The class of life insurance

- on death,

- in respect of an event or contingency dependent on human life,

- andre@brandandmortar.com

- for a term dependent on human life; and

- without limiting the generality of clause (a), includes

- insurance under which the insurer, as part of a contract of insurance that is within the class of life insurance, as that class is described in clause (a), undertakes

- ) to pay an additional amount of insurance money in the event of the death by accident of the person whose life is insured, and

- to pay insurance money or another thing of value in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

- an undertaking to provide an annuity, or what would be an annuity except that the periodic payments may be unequal in amount, for a term that depends solely or partly on a human life.

- insurance under which the insurer, as part of a contract of insurance that is within the class of life insurance, as that class is described in clause (a), undertakes

Marine Insurance

means insurance against

A contract of marine insurance is a contract whereby the insurer undertakes to indemnify the assured, in manner and to the extent thereby agreed, against marine losses, that is to say, the losses incident to marine adventure.

Mortgage Insurance

The class of mortgage insurance is insurance under which the insurer undertakes to indemnify a person against loss, or to pay insurance money or another thing of value in respect of loss, caused by default on the part of a borrower under a loan secured by

- a mortgage or charge on real property; or

- another security interest in real property.

Other Approved Products Insurance

The class of other approved products insurance is insurance under which the insurer undertakes to indemnify a person against loss or liability, or to pay insurance money or another thing of value in respect of loss, resulting from a risk that does not fall within another class of insurance.

Property Insurance

The class of property insurance is insurance under which the insurer undertakes to indemnify a person against, or to pay insurance money or another thing of value in respect of, the loss of or damage to property, including loss caused by forgery.

Surety Insurance

The class of surety insurance is insurance under which the insurer undertakes to pay insurance money or another thing of value as a guarantee

- of the due performance of a contract or undertaking; or

- for the payment of a penalty or indemnity for any default.

Title Insurance

The class of title insurance is insurance under which the insurer undertakes to indemnify a person against, or to pay insurance money or another thing of value in respect of, loss or damage caused by

- a defect in any document that evidences the creation of any restriction referred to in clause (a) or (b);

- a defect in the title to property; or

- any other matter affecting the title to property or affecting the right to the use and enjoyment of property.

Accident and Sickness Insurance

means insurance

- against loss resulting from bodily injury to, or the death of, a person caused by an accident,

- against loss resulting from bodily injury to, or the death of, a person caused by an accident,

- under which an insurer undertakes to pay a sum or sums of insurance money in the event of the sickness or disability of a person not caused by an accident, or

- under which an insurer undertakes to pay a sum of insurance money in respect of the health care, including dental care and preventative care, of a person.

Aircraft Insurance

means insurance against

- liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, in each case caused by an aircraft or the use of an aircraft, or

- the loss of, the loss of use of or damage to an aircraft;

Automobile Insurance

means insurance

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, in each case caused by an automobile or the use or operation of an automobile,

- against the loss of, the loss of use of, or damage to, an automobile, or

- that falls within subparagraph (i) or (ii) of the class of accident and sickness insurance, where the accident is caused by an automobile or the use or operation of an automobile, whether or not liability exists in respect of the accident, and the automobile insurance contract includes insurance against liability arising out of bodily injury to, or the death of, a person caused by an automobile or the use or operation of an automobile.

Boiler and Machinery Insurance

means insurance

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, in each case caused by an automobile or the use or operation of an automobile,

- against the loss of, the loss of use of, or damage to, an automobile, or

- that falls within subparagraph (i) or (ii) of the class of accident and sickness insurance, where the accident is caused by an automobile or the use or operation of an automobile, whether or not liability exists in respect of the accident, and the automobile insurance contract includes insurance against liability arising out of bodily injury to, or the death of, a person caused by an automobile or the use or operation of an automobile.

Credit Insurance

means insurance against loss to a person who has granted credit where the loss is the result of the insolvency or default of the person to whom the credit was given.

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual’s income or ability to earn an income.

Fidelity Insurance

means

- insurance against loss caused by the theft, the abuse of trust or the unfaithful performance of duties by a person in a position of trust, and

- insurance under which an insurer undertakes to guarantee the proper fulfillment of the duties of an office.

Hail Insurance

means insurance against the loss of, or damage to, crops in the field caused by hail.

Legal Expenses Insurance

means insurance against the costs incurred by a person or persons for legal services specified in the legal expenses insurance policy, including a retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services.

Liability Insurance

means insurance other than insurance that is incidental to another class of insurance,

- against liability arising out of bodily injury to or the disability or death of a person, including an employee,

- against liability arising out of the loss of or damage to property, or

- where the liability insurance contract includes the insurance described in subparagraph (i), against expenses arising out of bodily injury to a person other than the insured or a member of the insured's family, whether or not liability exists.

Life Insurance

means

- insurance that is payable

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay an additional sum of insurance money in the event of the death by accident of the person whose life is insured,

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

- (iii) insurance under which an insurer, as part of a contract of life insurance, undertakes to pay insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

Marine Insurance

means insurance against losses incidental to marine adventure which may by the express terms of a contract or by usage of trade extend so as to protect the insured against losses on inland waters or by land or air which are incidental to a sea voyage.

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on real property or an immovable, a hypothec on an immovable or another interest in real or immovable property.

Other Approved Products Insurance

means insurance against risks that do not fall within another class of insurance.

Property Insurance

means insurance against the loss of, or damage to, property and includes insurance against loss caused by forgery.

Surety Insurance

means insurance under which an insurer undertakes to guarantee the due performance of a contract or undertaking or the payment of a penalty or indemnity for a default.

Title Insurance

means insurance against loss or damage caused by

- a defect in any document that evidences the creation of any restriction referred to in subclause (i) or (ii),

- a defect in the title to property, or

- another matter affecting the title to property or affecting the right to the use and enjoyment of property.

Accident Insurance

means insurance by which the insurer undertakes, otherwise than incidentally to some other class of insurance defined by or under this Act, to pay insurance money in the event of accident to the person or persons insured, but does not include insurance by which the insurer undertakes to pay insurance money both in the event of death by accident and in the event of death from any other cause.

Sickness Insurance

means insurance by which the insurer undertakes to pay insurance money in the event of sickness of the person or persons insured, but does not include disability insurance.

Aircraft Insurance

means insurance against loss of or damage to an aircraft and against liability for loss or damage to persons or property caused by an aircraft or by the operation thereof.

Automobile Insurance

means insurance

- against liability arising out of ,

- bodily injury to or the death of a person, or

- loss of or damage to property,

- against loss or damage to an automobile and the loss of use thereof,

Boiler and Machinery Insurance

means insurance against loss or damage to property and against liability for loss or damage to persons or property through the explosion, collapse, rupture, or breakdown of, or accident to, boilers or machinery of any kind.

Credit Insurance

means insurance against loss to the insured through the insolvency or default of a person to whom credit is given in respect of goods, wares or merchandise.

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual's income or ability to earn income.

Employers' Liability Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss to an employer through liability for accidental injury to or death of an employee arising out of or in the course of his employment, but does not include workmen's compensation insurance.

Endowment Insurance

means an undertaking to pay an ascertained or ascertainable sum at a fixed future date, if the person whose life is insured is then alive, or at his death, if he dies before such date.

Fidelity Insurance

means

- insurance against loss caused by the theft, the abuse of trust or the unfaithful performance of duties by a person in a position of trust, or

- insurance under which an insurer undertakes to guarantee the proper fulfilment of the duties of an office.

Fire Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss of or damage to property through fire, lightening or explosion due to ignition.

Guarantee Insurance

means the undertaking to perform an agreement or contract or to discharge a trust, duty or obligation upon default of the person liable for such performance or discharge or to pay money upon such default or in lieu of such performance or discharge or where there is loss or damage through such default, and includes insurance against loss or liability for loss due to the invalidity of the title to any property or of any instrument or to any defect in such title or instrument, but does not include credit insurance.

Hail Insurance

means insurance against loss of or damage to growing crops caused by hail.

Inland Transportation Insurance

means insurance, other than marine insurance, against loss of or damage to property,

- while in transit or during delay incidental to transit, or property, or

- where, in the opinion of the Superintendent, the risk is substantially a transit risk.

Legal Expense Insurance

means insurance against the costs incurred by a person or persons for legal services specified in the policy, including any retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services.

Liability Insurance

means insurance, other than insurance that falls within another class of insurance,

- against liability arising out of the bodily injury to or the disability or death of a person, including an employee,

- against liability arising out of the loss of or damage to property, or

- if the policy includes the insurance described in paragraph (a), against expenses arising out of bodily injury to a person other than the insured or a member of the insured's family, whether or not liability exists

Life Insurance

means insurance whereby an insurer undertakes to pay insurance money,

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

- accidental death insurance but not accident insurance,

- disability insurance; and

- an undertaking, entered into by an insurer in the ordinary course of its business, to provide an annuity, or what would be an annuity except that the periodic payments may be unequal in amount.

Livestock Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss through death or sickness of or accident to an animal.

Marine Insurance

a contract of marine insurance is a contract whereby the insurer undertakes to indemnify the insured, in the manner and to the extent agreed in the contract, against

- losses that are incidental to a marine adventure or an adventure analogous to a marine adventure, including losses arising from a land or air peril incidental to such an adventure if they are provided for in the contract or by usage of the trade; or

- losses that are incidental to the building, repair or launch of a ship.

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on, or other security interest in, real property.

Plate Glass Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss of or damage to plate, sheet or window glass, whether in place or in transit.

Property Damage Insurance

means insurance against loss of or damage to property that is not included in or incidental to some other class of insurance defined by or under this Act.

Property Insurance

means insurance against the loss of or damage to property and includes insurance against loss caused by forgery.

Public Liability Insurance

means insurance against loss or damage to the person or property of others that is not included in or incidental to some other class of insurance defined by or under this Act.

Sprinkler Leakage Insurance

means insurance against loss of or damage to property through the breakage or leakage of sprinkler equipment or other fire protection system, or of pumps, water pipes or plumbing and its fixtures.

Surety Insurance

means insurance under which an insurer undertakes to guarantee the due performance of a contract or undertaking or the payment of a penalty or indemnity for any default.

Theft Insurance

means insurance against loss or damage through theft, wrongful conversion, burglary, house-breaking, robbery or forgery.

Title Insurance

means insurance against loss or damage caused by,

- the existence of a mortgage, charge, lien, encumbrance, servitude or any other restriction on real property,

- the existence of a mortgage, charge, lien, pledge, encumbrance or any other restriction on personal property,

- a defect in any document that evidences the creation of any restriction referred to in paragraph (a) or (b),

- a defect in the title to property, or

- any other matter affecting the title to property or affecting the right to the use and enjoyment of property.

Weather Insurance

means insurance against loss or damage through windstorm, cyclone, tornado, rain, hail, flood or frost, but does not include hail insurance.

Workmen's Compensation Insurance

means insurance of an employer against the cost of compensation prescribed by statute for bodily injury, disability or death of a workman through accident or disease arising out of or in the course of his employment.

Accident Insurance

means insurance by which the insurer undertakes, otherwise than incidentally to some other class of insurance defined by or under this Act, to pay insurance money in the event of accident to the person or persons insured, but does not include insurance by which the insurer undertakes to pay insurance money both in the event of death by accident and in the event of death from any other cause.

Sickness Insurance

means insurance by which the insurer undertakes to pay insurance money in the event of sickness of the person or persons insured, but does not include disability insurance.

Aircraft Insurance means insurance

means insurance against loss of or damage to an aircraft and against liability for loss or damage to persons or property caused by an aircraft or by the operation of an aircraft.

Automobile Insurance

means insurance

- against liability arising out of ,

- bodily injury to or the death of a person, or

- loss of or damage to property,

- against loss or damage to an automobile and the loss of use thereof,

Boiler and Machinery Insurance

means insurance against loss of or damage to persons or property and against liability for loss or damage to persons or property through the explosion, collapse, rupture or breakdown of, or accident to, boilers or machinery of any kind.

Credit Insurance

means insurance against loss to the insured through the insolvency or default of a person to whom credit is given in respect of goods, wares or merchandise.

Fidelity Insurance

being

- insurance against loss caused by the unfaithful performance of duties by a person in a position of trust, or

- insurance by which means an insurer undertakes to guarantee the proper fulfillment of the duties of an office.

Hail Insurance

No definition found in the Act or regulations.

Liability Insurance

being insurance not incidental to some other class of insurance against liability arising out of

- bodily injury to or the death of a person, including an employee, or

- loss or damage to property,

Life Insurance

means insurance by which an insurer undertakes to pay insurance money,

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

Marine Insurance

means insurance against,

- liability arising out of

- bodily injury to or death of a person, or

- the loss of or damage to property, or

- the loss of or damage to property,

Mortgage Insurance

being insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage on real property, a hypothec on immovable property or an interest in real or immovable property.

Property Insurance

being insurance within the meaning of fire insurance, inland transportation insurance, livestock insurance, plate glass insurance, sprinkler leakage insurance, theft insurance and weather insurance.

Surety Insurance

being insurance by which an insurer undertakes to guarantee

- the due performance of a contract or undertaking, or

- the payment of a penalty or indemnity for any default,

Title Insurance

means insurance against loss or liability for loss due to the invalidity of the title to any property or of any instrument, or to any defect in such title or instrument.

Employers’ liability insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss to an employer through liability for accidental injury to or death of an employee arising out of or in the course of his or her employment, but does not include workers’ compensation insurance.

Endowment Insurance

as applied to a fraternal society, means an undertaking to pay an ascertained or ascertainable sum at a fixed future date if the person whose life is insured is then alive, or at the death of that person if that person dies before that date.

Fire insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss of or damage to property through fire, lightning or explosion due to ignition.

Guarantee insurance

means the undertaking to perform an agreement or contract or to discharge a trust, duty or obligation on default of the person liable for the performance or discharge or to pay money on the default or in place of the performance or discharge, or where there is loss or damage through the default, but does not include credit insurance.

Weather Insurance

means insurance against loss or damage through windstorm, cyclone, tornado, rain, hail, flood or frost, but does not include hail insurance.

Inland transportation insurance

means insurance, other than marine insurance, against loss of or damage to property,

- while in transit or during delay incidental to transit, or

- where, in the opinion of the Superintendent, the risk is substantially a transit risk.

Livestock insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss through the death or sickness of or accident to an animal.

Plate glass insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss of or damage to plate, sheet or window glass, whether in place or in transit.

Property damage insurance

means insurance against loss of or damage to property that is not included in or incidental to some other class of insurance defined by or under this Act.

Public Liability Insurance

means insurance against loss or damage to the person or property of others that is not included in or incidental to some other class of insurance defined by or under the Northwest Territories Insurance Act.

Sprinkler leakage insurance

means insurance against loss of or damage to property through the breakage or leakage of sprinkler equipment or other fire protection system, or of pumps, water pipes or plumbing and its fixtures;

Theft insurance

means insurance against loss or damage through theft, wrongful conversion, burglary, house-breaking, robbery or forgery

Weather insurance

No definition found in the Act or regulations.

Workmen's Compensation Insurance

means the provision of compensation to workers under the Workers’ Compensation Act, or an enactment of similar purpose elsewhere in Canada.

Accident Insurance

means insurance by which the insurer undertakes, otherwise than incidentally to some other class of insurance defined by or under this Act, to pay insurance money in the event of accident to the person or persons insured, but does not include insurance by which the insurer undertakes to pay insurance money both in the event of death by accident and in the event of death from any other cause.

Sickness Insurance

means insurance by which the insurer undertakes to pay insurance money in the event of sickness of the person or persons insured, but does not include disability insurance.

Aircraft Insurance

means insurance against

- liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, in each case caused by an aircraft or the use of an aircraft; or

- the loss of, the loss of use of, or damage to, an aircraft.

Automobile Insurance

means insurance

- against liability arising out of ,

- bodily injury to or the death of a person, or

- loss of or damage to property,

- against loss or damage to an automobile and the loss of use thereof,

Boiler and Machinery Insurance”

means insurance

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, or against the loss of, or damage to, property, in each case caused by the explosion or rupture of, or accident to, pressure vessels of any kind or pipes, engines and machinery connected to or operated by those pressure vessels; or

- against liability arising out of bodily injury to, or the death of, a person, or the loss of, or damage to, property, or against the loss of, or damage to, property, in each case caused by a breakdown of machinery.

Credit Insurance

means insurance against loss to a person who has granted credit if the loss is the result of the insolvency or default of the person to whom the credit was given..

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual’s income or ability to earn an income.

Fidelity Insurance

means

- insurance against loss caused by the theft, the abuse of trust or the unfaithful performance of duties, by a person in a position of trust; and

- insurance under which an insurer undertakes to guarantee the proper fulfillment of the duties of an office.

Hail Insurance

means insurance against the loss of, or damage to, crops in the field caused by hail.

Legal expenses insurance

means insurance against the costs incurred by a person or persons for legal services specified in the policy, including any retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services.

Liability Insurance

means insurance, other than insurance that falls within another class of insurance,

- against liability arising out of bodily injury to, or the disability or death of, a person, including an employee;

- against liability arising out of bodily injury to, or the disability or death of, a person, including an employee;

- if the policy includes the insurance described in paragraph (a), against expenses arising out of bodily injury to a person other than the insured or a member of the insured’s family, whether or not liability exists.

Life Insurance

means insurance whereby an insurer undertakes to pay insurance money

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

- accidental death insurance but not accident insurance,

- disability insurance, and

Marine Insurance

" is a contract whereby the insurer undertakes to indemnify the assured in the manner and to the extent thereby agreed and includes any insurance, and reinsurance, made upon any ship or vessel or upon the machinery, tackle or furniture of any ship or vessel, or upon any goods, merchandise or property of any description whatever on board of any ship or vessel, or upon the freight of, or any other interest which may be lawfully insured in or relating to any ship or vessel, and includes any insurance of goods, merchandise or property for any transit which includes not only a sea or marine risk, but also any other risk incidental to the transit insured from the commencement of the transit to the ultimate destination covered by the insurance.

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on, or other security interest in, real property.

Property Insurance

means insurance against the loss of, or damage to, property and includes insurance against loss caused by forgery.

Surety Insurance

means insurance under which an insurer undertakes to guarantee the due performance of a contract or undertaking or the payment of a penalty or indemnity for any default.

Title Insurance

means insurance against loss or damage caused by

- the existence of a mortgage, charge, lien, encumbrance, servitude or any other restriction on real property;

- the existence of a mortgage, charge, lien, pledge, encumbrance or any other restriction on personal property;

- a defect in any document that evidences the creation of any restriction referred to in paragraph (a) or (b);

- a defect in the title to property; or

- any other matter affecting the title to property or affecting the right to the use and enjoyment of property.

Accident Insurance

Accident Insurance

means insurance by which the insurer undertakes, otherwise than incidentally to some other class of insurance defined by or under this Act, to pay insurance money in the event of accident to the person or persons insured, but does not include insurance by which the insurer undertakes to pay insurance money both in the event of death by accident and in the event of death from any other cause.

Sickness Insurance

Sickness Insurance

means insurance by which the insurer undertakes to pay insurance money in the event of sickness of the person or persons insured, but does not include disability insurance.

Aircraft Insurance

Aircraft Insurance

means insurance against loss of or damage to an aircraft and against liability for loss or damage to persons or property caused by an aircraft or by the operation of an aircraft.

Automobile Insurance

Automobile Insurance

means insurance

- against liability arising out of ,

- bodily injury to or the death of a person, or

- loss of or damage to property,

- against loss or damage to an automobile and the loss of use thereof,

Boiler and Machinery Insurance

Boiler and Machinery Insurance

means insurance against loss of or damage to persons or property and against liability for loss or damage to persons or property through the explosion, collapse, rupture or breakdown of, or accident to, boilers or machinery of any kind.

Credit Insurance

Credit Insurance

means insurance against loss to the insured through the insolvency or default of a person to whom credit is given in respect of goods, wares or merchandise.

Fidelity Insurancebeing

Fidelity Insurancebeing

- insurance against loss caused by the unfaithful performance of duties by a person in a position of trust, or

- insurance by which means an insurer undertakes to guarantee the proper fulfillment of the duties of an office.

Hail Insurance

Hail Insurance

No definition found in the Act or regulations.

Liability Insurance

Liability Insurance

being insurance not incidental to some other class of insurance against liability arising out of

- bodily injury to or the death of a person, including an employee, or

- bodily injury to or the death of a person, including an employee, or

Life Insurance

Life Insurance

means insurance by which an insurer undertakes to pay insurance money,

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life,

Marine Insurance

Marine Insurance

means insurance against,

- liability arising out of

- bodily injury to or death of a person, or

- the loss of or damage to property, or

- the loss of or damage to property,

Mortgage Insurance

Mortgage Insurance

being insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage on real property, a hypothec on immovable property or an interest in real or immovable property.

Property Insurance

Property Insurance

being insurance within the meaning of fire insurance, inland transportation insurance, livestock insurance, plate glass insurance, sprinkler leakage insurance, theft insurance and weather insurance.

Surety Insurance

Surety Insurance

being insurance by which an insurer undertakes to guarantee

- the due performance of a contract or undertaking, or

- the payment of a penalty or indemnity for any default, but not including insurance coming within the class of credit insurance or mortgage insurance.

Title Insurance

Title Insurance

means insurance against loss or liability for loss due to the invalidity of the title to any property or of any instrument, or to any defect in such title or instrument.

Employers’ Liability Insurance

Employers’ Liability Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss to an employer through liability for accidental injury to or death of an employee arising out of or in the course of his or her employment, but does not include workers’ compensation insurance.

Endowment Insurance

Endowment Insurance

, as applied to a fraternal society, means an undertaking to pay an ascertained or ascertainable sum at a fixed future date if the person whose life is insured is then alive, or at the death of that person if that person dies before that date.

Guarantee Insurance

Guarantee Insurance

means the undertaking to perform an agreement or contract or to discharge a trust, duty or obligation on default of the person liable for the performance or discharge or to pay money on the default or in place of the performance or discharge, or where there is loss or damage through the default, but does not include credit insurance.

Inland Transportation Insurance

Inland Transportation Insurance

means insurance, other than marine insurance, against loss of or damage to property,

- while in transit or during delay incidental to transit, or

- where, in the opinion of the Superintendent, the risk is substantially a transit risk.

Livestock Insurance

Livestock Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss through the death or sickness of or accident to an animal.

Plate Glass Insurance

Plate Glass Insurance

means insurance, not being insurance incidental to some other class of insurance defined by or under this Act, against loss of or damage to plate, sheet or window glass, whether in place or in transit.

Property Damage Insurance

Property Damage Insurance

means insurance against loss of or damage to property that is not included in or incidental to some other class of insurance defined by or under this Act.

Public Liability Insurance

Public Liability Insurance

means insurance against loss or damage to the person or property of others that is not included in or incidental to some other class of insurance defined by or under the Northwest Territories Insurance Act.

Sprinkler Leakage Insurance

Sprinkler Leakage Insurance

means insurance against loss of or damage to property through the breakage or leakage of sprinkler equipment or other fire protection system, or of pumps, water pipes or plumbing and its fixtures.

Theft Insurance

Theft Insurance

means insurance against loss or damage through theft, wrongful conversion, burglary, house-breaking, robbery or forgery.

Weather insurance

Weather insurance

No definition found in the Act or regulations.

Workers’ Compensation Insurance

Workers’ Compensation Insurance

means the provision of compensation to workers under the Workers’ Compensation Act, or an enactment of similar purpose elsewhere in Canada.

Accident and Sickness Insurance

means insurance

- against loss resulting from bodily injury to, or the death of, a person caused by an accident,

- under which an insurer undertakes to pay a certain sum or sums of insurance money in the event of bodily injury to, or the death of, a person caused by an accident,

- against loss resulting from the sickness or disability of a person, excluding loss resulting from an accident or death,

- under which an insurer undertakes to pay a certain sum or sums of insurance money in the event of the sickness or disability of a person not caused by an accident, or

- under which an insurer undertakes to pay insurance money in respect of the health care, including dental care and preventative care, of a person;

Aircraft Insurance

means insurance against

- liability arising out of bodily injury to or the death of a person or the loss of or damage to property, in each case caused by an aircraft or the use of an aircraft, or

- the loss of, the loss of use of or damage to an aircraft;

Automobile Insurance

means insurance

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, in each case caused by an automobile or the use or operation of an automobile,

- against the loss of, the loss of use of or damage to an automobile, or

- that falls within paragraph (a) or (b) of the class of accident and sickness insurance, if the accident is caused by an automobile or the use or operation of an automobile, whether or not liability exists in respect of the accident, and the automobile insurance contract includes insurance against liability arising out of bodily injury to, or the death of, a person caused by an automobile or the use or operation of an automobile.

Boiler and Machinery Insurance

means insurance

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, or against the loss of or damage to property, in each case caused by the explosion or rupture of or accident to pressure vessels of any kind or pipes, engines and machinery connected to or operated by those pressure vessels, or

- against liability arising out of bodily injury to or the death of a person, or the loss of or damage to property, or against the loss of or damage to property, in each case caused by a breakdown of machinery;

Credit Insurance

means insurance against loss to a person who has granted credit if the loss is the result of the insolvency or default of the person to whom the credit was given;

Credit Protection Insurance

means insurance under which an insurer undertakes to pay off credit balances or debts of an individual, in whole or in part, in the event of an impairment or potential impairment in the individual’s income or ability to earn an income;

Fidelity Insurance

means

- insurance against loss caused by the theft, the abuse of trust or the unfaithful performance of duties, by a person in a position of trust; and

- insurance under which an insurer undertakes to guarantee the proper fulfillment of the duties of an office.

Hail Insurance

means insurance against the loss of or damage to crops in the field caused by hail;

Legal Expenses Insurance

means insurance against the costs incurred by a person or persons for legal services specified in the policy, including any retainer and fees incurred for the services, and other costs incurred in respect of the provision of the services;

Liability Insurance

means insurance, other than insurance that falls within another class of insurance,

- against liability arising out of bodily injury to or the disability or death of a person, including an employee,

- against liability arising out of the loss of or damage to property, or

- if the liability insurance contract includes the insurance described in paragraph (a), against expenses arising out of bodily injury to a person other than the insured or a member of the insured’s family, whether or not liability exists.

Life Insurance

- means any insurance that is payable

- on death,

- on the happening of an event or contingency dependent on human life,

- at a fixed or determinable future time, or

- for a term dependent on human life; and

- without restricting the generality of paragraph (a), includes

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay an additional sum of insurance money in the event of the death by accident of the person whose life is insured,

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

- insurance under which an insurer, as part of a contract of life insurance, undertakes to pay insurance money or to provide other benefits in the event that the person whose life is insured becomes disabled as a result of bodily injury or disease, and

Marine Insurance

means insurance against

- liability arising out of,

- bodily injury to or the death of a person, or

- the loss of or damage to property, or

- (the loss of or damage to property, occurring during a voyage or marine adventure at sea or on an inland waterway or during delay incidental thereto, or during transit otherwise than by water incidental to such a voyage or marine adventure.

Mortgage Insurance

means insurance against loss caused by default on the part of a borrower under a loan secured by a mortgage or charge on real property or an immovable, a hypothec on an immovable or any other interest in real or immovable property.

Other Approved Products Insurance

means insurance against risks that do not fall within another class of insurance.

Property Insurance

means insurance against the loss of or damage to property and includes insurance against loss caused by forgery.

Surety Insurance

means insurance under which an insurer undertakes to guarantee the due performance of a contract or undertaking or the payment of a penalty or indemnity for any default.

Title Insurance

means insurance against loss or damage caused by

- a defect in any document that evidences the creation of any restriction referred to in paragraph (a) or (b);

- a defect in the title to property, or

- any other matter affecting the title to property or affecting the right to the use and enjoyment of property;

Accident and Sickness Insurance

Accident and Sickness Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Accident and Sickness Insurance" under federal insurance legislation.

Aircraft Insurance

Aircraft Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Aircraft Insurance" under federal insurance legislation.

Automobile Insurance

Automobile Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Automobile Insurance" under federal insurance legislation.

Boiler and Machinery Insurance

Boiler and Machinery Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Boiler and Machinery Insurance" under federal insurance legislation.

Credit Insurance

Credit Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Credit Insurance" under federal insurance legislation.

Credit Protection Insurance

Credit Protection Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Credit Protection Insurance" under federal insurance legislation.

Fidelity Insurance

Fidelity Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Fidelity Insurance" under federal insurance legislation.

Hail Insurance

Hail Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Hail Insurance" under federal insurance legislation.

Legal Expenses Insurance

Legal Expenses Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Legal Expenses Insurance" under federal insurance legislation.

Liability Insurance

Liability Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Liability Insurance" under federal insurance legislation.

Life Insurance

Life Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Life Insurance" under federal insurance legislation.

Marine Insurance

Marine Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Marine Insurance" under federal insurance legislation.

Mortgage Insurance

Mortgage Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Mortgage Insurance" under federal insurance legislation.

Other Approved Products Insurance

Other Approved Products Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Other Approved Products Insurance" under federal insurance legislation.

Property Insurance

Property Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Property Insurance" under federal insurance legislation.

Surety Insurance

Surety Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Surety Insurance" under federal insurance legislation.

Title Insurance

Title Insurance

The office of the PEI Superintendent of Insurance advised that PEI follows the federal classes of insurance and definitions for the purpose of licensing insurers in PEI. Please refer to the definition of "Title Insurance" under federal insurance legislation.

Accident and Sickness Insurance

is insurance whereby the insurer offers one or more of the following protections:

- is insurance whereby the insurer offers one or more of the following protections:

- payment of an indemnity in the event of sickness or disability of an insured;

- reimbursement for expenses incurred as a result of the sickness of or an accident sustained by an insured;

- reimbursement for expenses incurred for the health care of an insured.

Aircraft Insurance

is insurance whereby the insurer undertakes to indemnify the insured against material loss or damage resulting from an event involving an aircraft. It includes protection against the financial consequences of liability arising out of bodily injury or damage to property caused by an aircraft or the use of it.

Automobile Insurance

is insurance whereby the insurer undertakes to indemnify the insured against material loss or damage resulting from an event involving a motor vehicle, under the terms of the insurance policies approved by the Autorité des marchés financiers under section 422 of the Act respecting insurance.

It includes protection against the financial consequences of liability arising out of bodily injury or damage to property caused by a motor vehicle or the use or operation of a motor vehicle.

Insurance providing for payment of an indemnity in the event of bodily injury, including death, resulting from an accident involving a motor vehicle is also included in this class, provided that such insurance is part of a motor vehicle liability insurance contract.

Boiler and Machinery Insurance

is insurance providing one or more of the following protections:

- insurance whereby the insurer undertakes to indemnify the insured against material loss or damage sustained by the insured by reason of the explosion or rupture of a boiler or any other pressure vessel, including any mechanism, component or accessory incidental to its operation, or material loss or damage resulting from an accident in the course of its operation;